Best silver prices - we pay more than any of our local competitors for many silver items.

American Eagles

All Government Made Silver

90% Junk Silver

Old Morgan Silver Dollars

Old Peace Silver Dollars

Scrap Silver

Silver Bars & Rounds

Generic Silver

JM & Engelhard Bars and Rounds

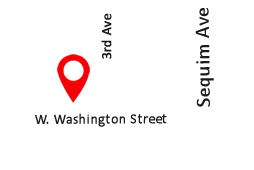

Bring your silver in today for a free appraisal.